Abstract

In Spring 2021, Kelly Kovack, CEO of BeautyMatter, held an Amazon Beauty discussion with Market Defense’s Julian Chu and Vanessa Kuykendall, as well as Lori Deo, former Global President at J&J, now a Principal at New England Consulting Group. The discussion surrounded key topics, like: how Amazon has evolved from a “no go zone” for Beauty brands to a key channel for growth, which tools and tactics drive brand equity, how to launch an Amazon-first strategy, and the role Amazon currently plays in private equity transactions. In this article, we summarize that discussion into ten topics currently on the minds of Beauty industry decision makers. Whether you are a brand executive, a digital marketer, an agency partner, a beauty insider, or an investment professional, you will take away valuable insights to guide your Amazon strategy.

1. How should brands be thinking about Amazon in 2021 from a strategic standpoint?

Kelly: The pandemic removed any last vestige of concern from beauty brand holdouts when it comes to integrating Amazon into their distribution strategy. Late adopters who hadn’t shopped on Amazon before were forced to use the platform during the pandemic, which I think is going to have a long-term impact on consumer behavior. And in truth, one way or another, products are going to end up on Amazon, especially if you’re a brand that is in demand.

Market Defense is in the business of helping brands control their destiny on Amazon. So, given the shift in perception and the willingness to embrace Amazon, how should brands be thinking about Amazon from a strategic standpoint?

Julian: Amazon is now an important part of the growth conversation, whereas a few years ago, especially for prestige beauty, it was not. It was viewed as a no-go zone: “We’re not going to do anything on Amazon, we’re focused on direct-to-consumer and other specialty retail.” Then we all realized:

"

"We’re on Amazon whether we like it or not, and unless we have an intentional strategy to do something about it, it’s going to get out of control. It’s going to negatively impact our brand, both from a brand equity point of view and a financial point of view."

- Kelly Kovack, CEO, BeautyMatter

And now, particularly after 2020, not only are brands thinking about how to employ a defensive strategy on Amazon, they’re thinking about how to employ a growth strategy on Amazon, knowing that so much of their customer base and their target prospects are there on Amazon.

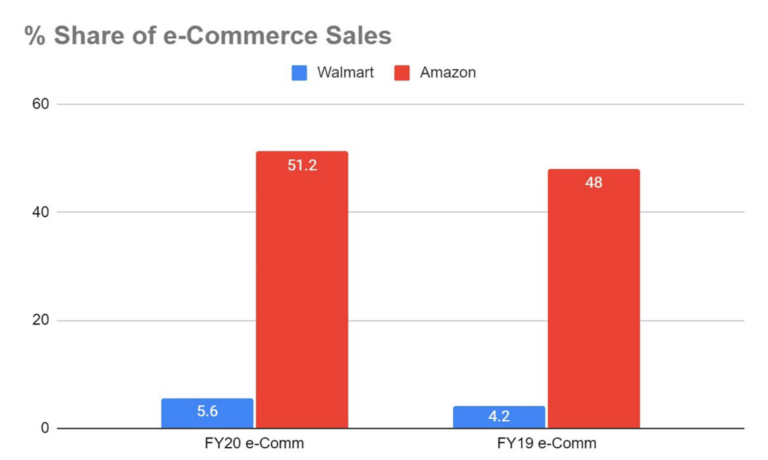

They are doing a lot more of their shopping online, and in particular on Amazon, which accounts for half of the e-commerce market overall and 10X that of its leading rival, Walmart – and is continuing to enjoy above market growth. It can no longer be ignored. It has to be part of your growth strategy.

Lori: I agree, and what I would also add from an investor perspective is that you have to fish where the fish are – you can’t ignore Amazon. It’s a very critical channel. Consumers have learned to go there, they love the convenience, they love the endless shelf, and you have to play there. You cannot win without playing in that channel. But, as any investor would want, it usually is about having a diversified channel strategy. So having Amazon in the mix along with other strategic channels is very important from an investor perspective. You don’t want all your eggs in one basket, and with that said, I think for brands, really being strategic in terms of their assortment strategy, what their offerings are going to be by channel, and how to have the channels win together in one space. You don’t want them to interfere with each other and the success you can have in those channels, but diversification is critical, and Amazon does need to be part of that mix.

Kelly: You know, Lori, from an investor standpoint, does how a brand show up on Amazon gives you an indication of how the brand thinks strategically? Where I’m going with this is, if a brand has a free-for-all on Amazon, does it give you some insight into how the brand operates?

Lori: What I would say from an investor perspective, there are so many things that you’re looking at when you’re examining any brand or business. Amazon certainly can give you a little more insight because of the visibility of the information, but it is a much broader mix than that. What I will share with you when I was in prestige beauty, and we had brands that we were looking to sell into say a Sephora or an Ulta or any other boutique specialty store, the first thing that the owners of brick-and-mortar would do is look at your Amazon presence and how you were showing up. Did you really have control of your brand, were you being strategic, or was it transactional? So, there are eyes on that – and where I’ve experienced it the most is when you’re looking to get

Kelly: Thanks Lori. Vanessa, do you see the same pushback from retailers of luxury and prestige brands being on Amazon? It used to be a no-go, if you were on Amazon, it ruffled lots of feathers, but it seems like that thinking has shifted dramatically.

Vanessa: It has, and I think the shift is within the brands’ point of view. They saw the massive shift to digital shopping in this last year by the consumer, and they were there to respond. They did their best to also support their brick-and-mortar partners with curbside pick-up and other areas of business. But, the brands understood that they need to go where the consumer is and the consumer is online, and shopping on Amazon more than half of the time.

The brands themselves have said:

"

“Look, I really need to manage my Amazon business. I really need to control it. I really need to be intentional, and put some ad spend behind it.”

What we’re also seeing is that retailers are saying:

"

“I get it, I understand. We’re here to be a partner to you in your growth, and we hope we’ll continue to have exclusives that are just for us as a retailer. We’ll continue to partner with you on programs.”

So yes, I think the tight reins on Amazon have loosened up, but I think it’s coming from the brands. I wouldn’t call it a pushback, I think it’s partnership. I think it’s just transparency, and I’m so thankful for the transparency as part of this industry. We are looking to have real conversations and address things in a really authentic fashion. Brands need to go where the consumer is, and the consumer was on Amazon the last twelve months.

Kelly: I think the pandemic knocked down the last rules around distribution. There are those unspoken rules and I think now there aren’t distribution channels, the customer is the distribution channel – and you need to show up where they are.

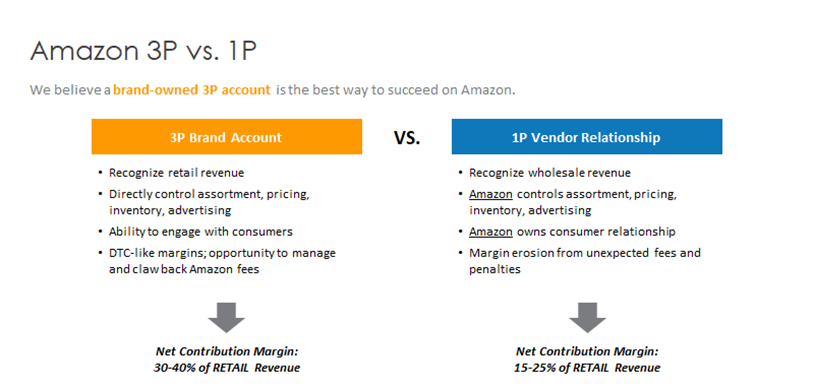

Julian: If I could build on that, I think brands really need to think about Amazon as an element of their direct-to-consumer strategy. Particularly if you’re pursuing a 3P model. The economics look like direct-to-consumer, the skillset required to execute well and the operating model you have to build is very, very similar to direct-to-consumer. Brands that are thinking about Amazon and talking to Amazon through their wholesale sales teams are missing the boat.

2. Can you explain the trend in private equity right now to buy independent companies and brands that are selling products on Amazon?

Kelly: There has been a lot of media around these private equity groups that have raised a tremendous amount of funding to go out and basically purchase products that are doing well on Amazon, tap into the cash flow, and then grow the businesses by putting more money against them. I’m not even quite sure what the strategies are, and I don’t remember what the number is, but it’s a lot of money, and surely it has had some effect on the ecosystem. Or, perhaps the Amazon ecosystem is large enough that it just kind of assumed it? Help me understand the impact.

Julian: There was a tremendous amount of venture funding put into these businesses. There’s probably – I lost count – at least a dozen major players now with subsidized funding behind them. I think the number begins with a “b” not an “m.” And they are executing on their strategy to go around buying product businesses that have established themselves on Amazon, where the entrepreneur has taken it to a certain point, where maybe it’s a two, three, four, five million annual run-rate. They buy them at a certain price, and they’re looking to grow those businesses on Amazon.

They are putting them on their platform, which is basically a capability to optimize your presence on Amazon, invest in the product, do marketing efficiently, and grow those businesses at scale. I think the theory is that having built essentially a platform or a set of capabilities that are strong, they can do much more with these businesses than independent entrepreneurs, which makes sense. And some of these companies are getting quite large. I’ve heard that one is driving EBIDA in the hundreds of millions of dollars – not revenue, EBIDA in the hundreds of millions of dollars. So, it seems to be working.

What is the impact on independent sellers on Amazon? Your life has just gotten a lot harder. The number of independent sellers and small brands continues to expand at a rapid clip on the marketplace, and it’s gotten a lot more competitive. The competition is consolidating. There are well-funded, very competent players that are consolidating the market in different ways. Brands, like the leading brands that Market Defense works with, are getting savvy about Amazon, and are prioritizing it.

Lori: I’ll build on Julian’s comments. I agree, there’s consolidation that’s happened and even more this year. There really is a focus on brands that have a presence on Amazon, and e-commerce in particular. Private equity is looking for businesses that are underdeveloped with opportunities to create and expand so they can generate that growth. And I think importantly, as Julian said, having the scale and capability to work across a breadth of businesses so that they could be very efficient and drive not only top line, but profit as well.

3. What is the strategy behind Amazon’s new Manage Your Customer Engagement (MYCE) tool?

Kelly: Amazon has quietly rolled out a way for some of their sellers on their site to engage with shoppers through a tool called Manage Your Customer Engagement (MYCE). That seems very unlike Amazon, because they try to put as much distance between you and the consumer as possible. What is the strategy behind it?

Vanessa: It’s true that Amazon has always considered the Amazon consumer their customer, and brands don’t own that customer in any way. You are selling directly to them in the third-party marketplace, you own an account, and you are communicating to the client in the way that you are selling products to them – just like a retailer would. However, you don’t have an opportunity to speak directly to them.

So, this attempt of Amazon at providing brands the ability to communicate with their customer is unique. It’s also pretty convoluted, to be honest. The customer must go to your storefront, they have to follow you, not unlike following you on a social media page, and then you are able to engage with your customer. Do customers even know to do that? Is Amazon going to partner with brands and communicate to consumers that they need to go to a storefront and follow? I don’t know – but I do think it’s an interesting step in the direction of giving brands the ability to communicate directly with clients.

How I foresee the brands at Market Defense using it is being able to communicate to a customer that they have a new launch coming – maybe an Amazon exclusive, that they wouldn’t be able to purchase at any other retailer. Or letting them know about a promotional opportunity. Brands are now much more engaged in Prime Day in the Beauty category than they ever have been before, so maybe they would want to let customers know, “hey, we’re going to be including you in this promotional event.” That’s how I think Market Defense is going to use it, but let’s see how many customers engage.

4. How has Amazon changed in the past three years from the perspective of a P&L owner – and what are your thoughts on Amazon 1P vs. 3P?

Kelly: From the perspective of having been a P&L owner, Lori, how has Amazon changed over the past three years, when you think about the role that Amazon plays for brands? And beyond that, I’d love to know your thoughts on Amazon 1P versus 3P.

Lori: As far as the role Amazon plays, what I would say – and I kind of alluded to this earlier – the channel mix and diversification have changed tremendously. Online sales have increased, not only through Amazon, but brick-and-mortar retailers continue to build their online capabilities, depending on what space you’re in. So, you have Amazon as well as your brick-and-mortar partners that have their in-store as well as online, and online continues to grow.

In addition, the demand from the customers or retailers continues to grow because they’re trying to build more capabilities. What I would also say is your assortment strategy has probably changed and gotten more complex as there are more channels that consumers can shop for their products, so you’re looking to make each of these channels unique and different in areas that make sense. Perhaps with unique or different offerings or exclusives which create complexity for the P&L. Sometimes there is some gross profit erosion that happens with that as well. And I’d say the last big thing as a P&L owner is the shift in the type of media support. Over the years, more and more media dollars have been put into search and digital advertising, and even moving into retailer media. And then, obviously, the accelerated sales that come with all of this.

And as far as your second question on 1P versus 3P, before I get into specifics, what I would say is that there is no right or wrong strategy. I think there are different ways to get onto Amazon. It’s really about what the brand’s objectives are and what its capabilities are. I would say the 1P relationship is definitely advantageous in terms of being more turnkey. Amazon takes your inventory and they manage a lot of your business for you, so if you don’t have the resources or a strong e-commerce team or partner to help you there, there are advantages. However, you do lose in being able to tell your story and certainly pricing in the marketplace.

And I think on the 3P side, it’s the reverse of that, so obviously there’s opportunities to control more of your pricing, how you tell your story, how your brand shows up, but you take on more responsibility for inventory and customer management. It’s really important to either have the capabilities or have a really strong 3P partner like Market Defense to help you in that area, because a lot of the smaller mom and pops are trying to get onto Amazon, it can be really challenging from a resource and a capabilities perspective.

5. What role does Amazon play when evaluating an investment target? What are investors looking for and what should brands be thinking about?

Kelly: Julian, I know you come from an investment background and Lori is currently at an investment firm. So, question for both of you. What role should or does Amazon play when evaluating an investment target? As an investor, what are you looking for, and what should brands be thinking about if they’re either looking to raise capital or contemplating an exit?

Lori: I can start. When investors are looking at whether they want to invest and whether there’s an attractive opportunity, a couple critical things that they look at:

• What is the market size opportunity, and is there an opportunity to increase household penetration?

• Do you have the right innovations for the future to grow in this space?

• And importantly, are you overdeveloped or underdeveloped in the channels?

So, at the end of the day, investors are trying to understand what the value creation plan for any brand or business looks like, and what that growth could be over the long-term, both top and bottom. Amazon and other channels play a role there. Are you underdeveloped, overdeveloped? Is the category developed or underdeveloped? And if there was investment, can you continue to grow, increase penetration, increase frequency? So it’s a very holistic review of a business, but the size on Amazon and how well developed the category is or is not can often really weigh into what the opportunity for an investment could look like. The more attractive the value creation plan is, the easier it is to persuade and bring investors on board to invest in that business. But they really have to believe in the plan, and Amazon does provide opportunity in terms of what the investment could look like.

Julian: For those of you who don’t know, my background is in private equity, and a few years ago, actually, I was on the client side and brought Market Defense in to work with the beauty brands in our portfolio. As an investor, when we’re evaluating new investment opportunities, relative to Amazon, what we’re looking for is two things:

- Is there demonstrated potential that has not yet been maximized?

- Does the team, the management team that you’re investing behind, get it?

You don’t want a situation where it seems like they don’t really understand what to do about Amazon, haven’t thought about it yet. But at the same time, you also don’t want someone who is so far down the path that the opportunity has been fully realized and it’s going to be a lot harder to realize upside from here. The ideal investment target is a company or a team that has started down that path and is still in the early beginnings, but you can see very clearly what the roadmap is going to be to drive outsized growth over the next three-to-five years. That’s the type of situation that really gets investors excited.

6. How can beauty brands build and grow their brand equity on Amazon?

Kelly: Vanessa, I know you’re an advocate for the potential of Amazon from a brand building standpoint, which honestly a few years ago would have been a completely incongruous concept. Amazon has really come a long way in providing tools to tell a story. So, when you contemplate storytelling on Amazon, can you share how beauty businesses should be approaching Amazon to maximize brand building? Because if you can build a strong brand, you can market on top of that, and then growth comes as an extension – but if you don’t have the brand foundation, none of it really works.

Vanessa: You’re right, and the foundation is knowing who you are as a brand. Be sure that you have the messaging down for your values. If you have philanthropy that you’re attached to, all of these things can help your problem/solution with your product, the features and benefits that make your product different than your competitors. What’s your point of view? You really need to hone in on that, because Amazon has a lot of products in every category, so you need to stand out. How can you if you’re not sure what your point of difference is? So, I would encourage brands, if you haven’t gone through that exercise lately to really understand who you are. And once you understand the story you have to tell, you can tell it on Amazon.

What tools does Amazon have for brand building? Amazon gives you opportunities to build robust storefronts; you can now use sponsored videos in ads. So right from the jump, when you are showing your product to a customer for the first time, they can get a feeling for who you are as a brand. We are using sponsored brand videos a lot now in our ad campaigns, not just at the listing level. You show them a video ad, they understand who you are, they jump into your listing, they can get more information about you from your A+ content and other videos there, as well as your social media posts. They engage with you on a product level, now take them to your store.

Really show them who you are there by telling your founder story. People like to know who is behind your brand, so open up, share, be honest, tell them where you came from, and tell them where your money goes. There are opportunities to talk about your philanthropies, that’s new. So, brand stories are new on Amazon. There continues to be more and more assets, and now we’re going to be able to communicate information directly to the consumer using Manage Your Customer Engagement (MYSE) which we discussed earlier. I know that it seems like customers are on Amazon and they’re just flying through and they’re throwing stuff in their cart, but that is no longer the case. They’re spending a lot more time before they make their decisions. We can see that through our heat maps, we know that the customer is spending more time on a product page, we know that they’re spending more time discovering across categories.

When we’re talking about storytelling, we’re talking about telling YOUR story, so really hone in on what that is, and you’ll be able to let that message come through on Amazon.

7. What is the Amazon Flywheel Effect and how can brands leverage this framework to drive sales?

Kelly: Julian, can you break down the Amazon Flywheel Effect for us? It’s a pretty big question, I apologize.

Julian: It’s a big question, but it’s a really important question, and I’m glad you asked it. The short answer is that you’ve got to give the Amazon machine what it wants. A lot of what happens on Amazon is algorithm-driven, and you need to understand how those algorithms work. At the end of the day, what Amazon wants is lots and lots of transactions and conversions and therefore sales on its platform. So, it will favor those brands, those seller accounts, those products that drive a lot of engagement, a lot of click through, a lot of conversion, and at the end of the day, a lot of sales.

The Amazon machine is built to favor all of the variables or attributes that feed into those end goals like your logistics and operational efficiency.

• Are your in-stock rates high?

• Are your sell-through rates high?

• How good are you at satisfying customers?

• Do you have really, really high – what they call – “perfect order scores” in terms of order fulfilment accuracy?

• Are customers giving you high seller ratings, again indicating high customersatisfaction?

• How good is your marketing?

• Is your marketing creative driving a lot of click-through engagement, impressions on those listings, and at the end of the day, conversions?

From your copy, your imagery, your videos, the quality and quantity of your product reviews – it is all hugely important on Amazon. All of those things feed into your ability to rank highly in search results and your ability to drive strong and superior ROI on your ad spend. Your advertising quality scores will be better, and therefore your CPCs will be lower, driving better ROI. And all of that allows you then to invest more in your brand, drive more volume, thus spinning that fly wheel even faster. It’s really important to take that holistic strategy and think about all of the different aspects of Amazon in order to make that work. And lest I forget that a critical aspect of that flywheel also is your control of the buy box, right? Because it’s no use driving a lot of views and traffic to listings if you’re not controlling the buy box and the sales are going to somebody else.

Kelly: And also, in creating this flywheel, it doesn’t just happen, you have to feed the machine. That is why you can’t have a passive Amazon strategy, right? You really need someone that is in it every day and understands how the widget works.

Julian: Absolutely – there are a lot of different aspects to it, and it’s difficult to know which levers to pull and how to pull them.

8. Brands are starting to launch with an Amazon-first strategy. What does it take to do that successfully?

Kelly: I’m seeing brands either launch, shift distribution strategies, or enter the U.S. market through an Amazon-first strategy, which is something really new. They’re using it for customer acquisition or proof of concept or testing product concepts. Vanessa, let’s start with you. Is this really happening or am I imagining it? And what does it take to really execute an Amazon-first strategy, or pivot to an Amazon-first strategy?

Vanessa: That’s a really great question, and yes, you’re right, you’re not crazy! There’s always been a handful of brands that originated on Amazon and grew into big shots, and we always have those stories to tell. Now though, there’s more and more brands who are following in their footsteps because they understand that you’ve got to lock down Amazon first, before you really start massive growth elsewhere. There’s no hard and fast rules on how to launch a brand, but if you don’t lock down Amazon and you launch elsewhere and everyone rushes to buy your product on Amazon and it’s not there, guess who’s going to get those sales? Competitors, poachers, counterfeiters, all of the above. You want to lock down Amazon if you really are intending to grow a big business.

So, what do you need to do? You need inventory. We’re running into brands who have Amazon as a strategy, as part of their market strategy, and yet they haven’t really carved out the amount of inventory. Those of you who are advertising on Amazon know this to be true, going out of stock is the kiss of death, because you’ve ramped up your advertising spend, it’s become relevant, and now you go out of stock. You want to make sure that you have a good amount of inventory, or at least the appropriate amount of inventory. And then I would also say, think about your assortment, because what is Amazon, like Julian said, if not an extension of your direct-to-consumer strategy? Have some Amazon exclusives, create something that’s unique for them. What do customers want? They want to be included. They want accessibility. They are looking to see solutions for perceived problems.

Recently with one of our brands, we realized that consumers were buying a particular serum and a moisturizer 70% of the time, and the brand itself didn’t duo those products. They felt they needed to live separately on the shelves across retailers. So, we decided to put that together. We were going to make it easy for the consumer to purchase their favorite products, easy as pie, subscribe and save, they’ll get it at home every three months. So I think you have the opportunity to craft the assortment that speaks best to your customer, because Amazon does give you the ability to do that.

9. What is the cost of acquiring new customers on Amazon?

Kelly: As it’s become more and more expensive and more competitive to acquire customers on social channels, we see people allocating that budget to Amazon. If you could unpack for us the economics of customer acquisition on Amazon, compared to what we’re seeing on traditional digital channels.

Julian: Yeah, great question. Did you see Facebook’s quarterly announcement yesterday? The average cost of ads in the quarter was up 30%. It’s great to be Facebook, great to be a Facebook developer. But it is increasingly challenging to drive ROI as an advertiser on Facebook, which is exactly why brands, including many of our clients are thinking:

"

“We’re seeing really great ROI on Amazon, through Ad Spend, which is not surprising, because it’s a shopping platform – not a social media platform or a general search platform. Consumers are shopping on Amazon, so it’s a great bottom-of-the-funnel tactic.”

For years, advertisers have been driving excellent ROI with Amazon search marketing and now with Amazon display marketing. The area that brands are now increasingly looking at and thinking about is: how can we leverage Amazon’s ad platforms to drive traffic and general brand awareness and potentially drive traffic to other channels, like our own e-commerce site? I think that and other Amazon brand-building tactics are going to be the way of the future – using Amazon display platform for non-Amazon channels, taking advantage of and participating in Amazon’s influencer and affiliate marketing programs, and live video feed shopping – that’s another avenue they’re experimenting with.

The toolset continues to get more and more diverse, and I think it’s important for brands to continually look at and experiment with these tools and try to find tactics that work for them that help them drive customer acquisition both on Amazon and off Amazon in more profitable ways. The other marketing channels that we know and love are very mature now, and they’re highly competitive and the costs are high. Marketers are always looking for what’s new – what’s next – where can they find opportunities to get in early, learn, and take advantage of the opportunity to drive outsized returns before the rest of the herd follows them.

10. Is Amazon a channel to test and learn? How does it compare to conducting a traditional proof-of-concept in brick-and-mortar retail?

Kelly: I’ve heard of brands using Amazon as a place to get proof-of-concept – and proof-of-concept is the holy grail in the path to tapping into investment. I’d love to hear your thoughts on how would you equate proof-of-concept on Amazon to the potential of a brand to then expand into traditional brick-and-mortar retail?

Lori: I see more brands moving towards Amazon-first, and I see it in other markets outside of the U.S. in terms of leveraging online platforms. I think the opportunity is – and Vanessa addressed a lot of this very well – you have a brand, you have a unique story, you have the inventory, and you’re looking for a less complicated channel in terms of what it would take to get distribution. I think Amazon is a great place to do a test-and-learn with consumers, measure the proof of concept, and find out if you can convert.

That’s the beauty of Amazon, you have some bigger players on there, driving awareness of the category, bringing the consumers in. So, can you convert people that are already coming into your category through the right tactics and promotions and advertising programs? And obviously, you would measure what are you spending versus what you’re getting in top line and conversions and sales.

I also think one of the great things that Amazon provides visibility into, is ratings and reviews. What are people saying about my products? What can I learn from that? How can I iterate? Trying out different products as well, changing up SKUs and bundling can easily be done on Amazon, as a way to test, learn, and iterate.

If you’d like to learn more about the full-service, 3P Amazon Services we provide to the top names in Beauty and Wellness, please visit www.marketdefense.com/services.

Or if you’d like to get in touch, you can reach us anytime at connect@marketdefense.com. We look forward to hearing from you.